Author: Gordon Dalton, HMRC-UCC, Ireland

This paper will address the topic of ‘Why wave energy’ by analysis the factors for consideration from two perspectives:

1. Why Wave Energy – for an Investor

The first section of this paper discusses why an investor would consider wave energy as an investment option. Investors today have the option of investing their finance in an enormous range of products/companies/ventures. The principal criteria which will determine their decision to invest will be the expected returnon their investment (some investments are driven by personal or philanthropic reason, but these are a minority). With return on investment as the driving force, an investor will compare wave energy projects to a host of other possible ventures. Investors usually specialise in certain product or industry sectors, determined by their past experiences and expertise. Thus, investors in wave energy will be familiar and interested in the energy sector in general, and more than likely have an interest in renewables.This paper investigates ‘why wave energy for a investor’ by assessing all the criteria and facts that an investor will need to investigate in order to make a decision on the viability for investment in either wave energy research, development, manufacture or deployment sectors.

1.1 Supply Analysis

1.1.1 Global Fossil Fuel Deposits

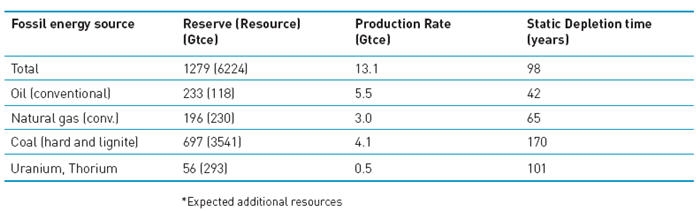

The level of global fossil fuel reserves will have a direct bearing on the future attractiveness and viability of renewable energy. Accurate forecasting of this trend will dictate investment in renewables. Statistics presented in Table 1 indicate that there is ample coal reserves left for nearly 200 years. Thus an investor could be wary of investing in wave energy technologies or wave farm development in countries that have large deposits of coal, or access to cheap coal. On the other hand, oil reserves have less than 50 years left. Thus countries heavily dependent on oil imports would be countries most likely to require high renewable energy targets in the near future to offset the high price of oil which will inevitably result from future limited supply. In summary, countries that have limited fossil fuel reserves and large wave energy capacity are the optimum countries on which to focus investment.

Table 1. Fossil reserves, resources, consumption rates, depletion time, and solar delivery times [1] (Giga tonnes coal equivalent (1 Gtce) = 29 EJ = 8,140 TWh thermal = 5 Billion bbl)

1.1.2 Cost of Fossil Fuel Deposits

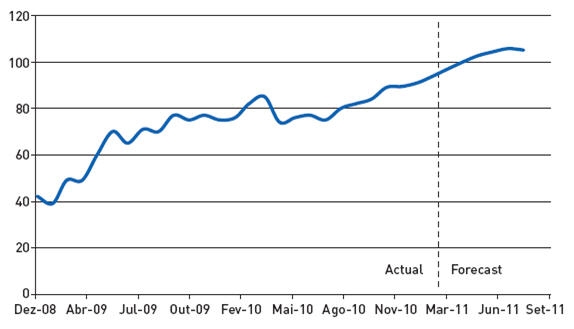

High and fluctuating fossil fuel prices are a major driver for the competitiveness and utilisation of renewable energy technologies [2]. Since 2000, the prices of fossil fuels, and in particular oil prices, have increased significantly by approximately three times (Figure 1). Oil prices are forecast to continue to increase in price for the foreseeable future. These price fluctuations may provide an essential driver for investments in renewable and wave energy technologies.

Figure 1. Crude oil past & future projection. West Texas Intermediate in US Dollars per barrel.1

1.1.3 Supply Predictions for Wave Energy

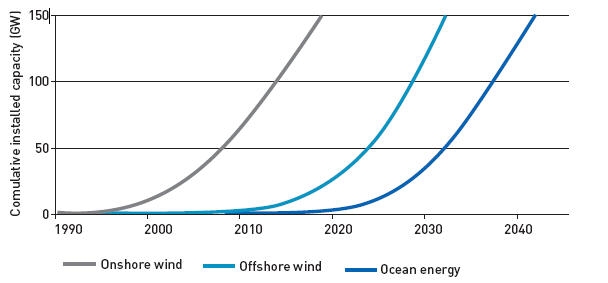

An investor will need to assess the predicted maximum capacity that wave energy can produce given ideal conditions, and compare these to exiting onshore and offshore wind competition. Wave energy is predicted to supply 188GW of renewable power to Europe by 2050, and will have a similar proportion of the renewable energy mix as offshore and onshore wind (Figure 2) [3]. An estimated 150 GW of wave energy production by 2030 would contribute 11-14% of total electricity consumption In Europe2.

In 2007 the countries of the European Union consumed 2,926 TWh of electricity [3]. Ocean energy generation has a potential to reach 3.6 GW of installed capacity by 2020 and close to 188 GW by 2050. This represents over 9 TWh/ year by 2020 and over 645TWh/year by 2050, amounting to 0.3% and 15% of the projected EU-27 electricity demand by 2020 and 2050 respectively. The numbers presented are achievable targets for ocean energy at the European level. The vast quantity of available wave energy is therefore a sizeable energy reserve that can be tapped for investment.

Figure 2. Estimated installed capacity of onshore, offshore wind and wave energy [3].

1.2 Demand Analysis: Fossil Fuel and Green Energy

Investors interested in the energy supply market will need to do a full assessment of future demand for the following:

1.2.1 General Energy and Electricity Demand

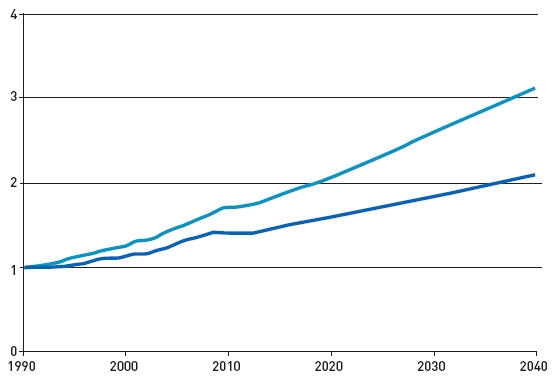

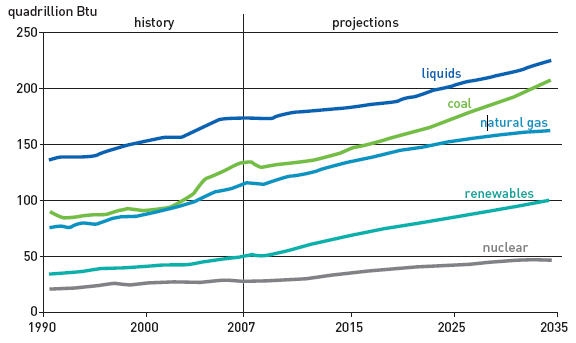

The German government’s scientific advisory board on global energy consumption assumes a rise by a factor 4 to 1,600 EJ or 55 Gtce (Giga tonnes coal equivalent,1 Gtce = 29 EJ), respectively, from the year 2000 until 2100 [4]. Forecasts from the US indicate the energy demand will double until 2030 and electricity demandwill triple (Figure 3).

In conclusion, investors should view the strong forecasted demand growth for energy and electricity as positive indicators for future investment consideration in the energy sector.

Figure 3. Growth in world electric power generation (green line) and total energy consumption (blueline), 1990-2035. Index, 1990 = 1. (Energy Information Agency, US)3

1.2.2 Renewable Energy Demand

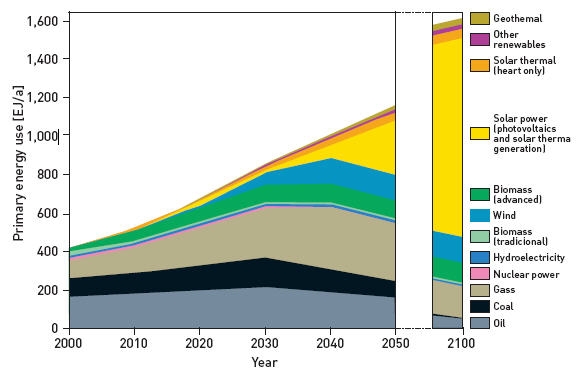

As fossil fuel resources are facing depletion, it is anticipated that the deficit can be filled in part by renewable sources of energy. Predictions by the US Energy Administration Bureau [5] indicate the renewable energy has a strong growth market increasing at the same rate as the other fuel types (Figure 4). Figure 5 splits the renewable portion of the fuel mix into its constituents. Knies [4] reports from a German study that solar will be the most prevalent renewable energy form by 2050 and ubiquitous by 2100. ‘Others’ described in the graph could refer to wave energy, but is not qualified. A more conservative report from EC. Europa [6] sees a modest growth of all fuel types with biomass as the greatest growth fuel. Wave energy is not described in any graphs of the types, however it is assumed that it forms some portion of the “others”. The current market proportion is certainly small in comparison to other renewables, but one can assume that it will be a growing one if it follows the trend that other renewables have taken, such as offshore wind [7].

Figure 4. Energy fuel mix predicted for 2015, 2025 and 2035 (Energy Information Agency, US [5]

Figure 5. Development of global primary energy demand according to the scenario “exemplary path”by the scientific advisory board (WBGU) to the German government [4].

1.3 Target Penetration of Green Energy

Investment in renewable energy technologies in certain countries will be directly proportional to the strategic plan of the national government of the country. National targets have been set in most European countries for:

1.3.1 Renewable Energy – general

National renewable energy targets for European countries are displayed inFigure 6. The countries with the highest targets by 2020 are Denmark, Estonia,Spain, France, Austria, Portugal, Finland and Sweden

Figure 6. EU national targets for the contribution of electricity produced from renewable energy sources in percent (%) of gross final consumption, comparing 2005 to 20204.

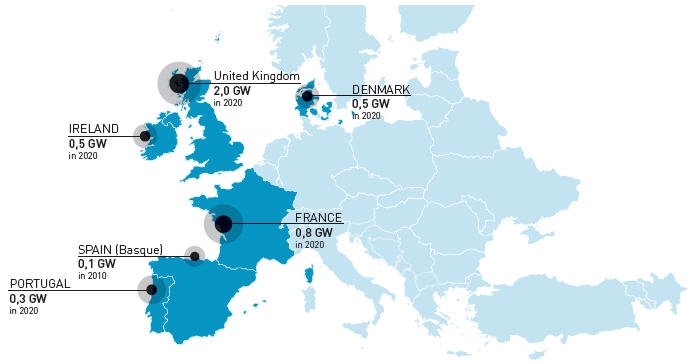

1.3.2 Wave Energy Targets

The UK has the highest wave energy target for 2020, at 2GW (Figure 7). Thisis double that of France and 4 times that of Ireland, Portugal and Denmark. However, it must be remembered that the UK has 10 times the population of these countries, so for per head of population perspective, Ireland, Portugal and Denmark are setting very high targets. Thus the investment made by these countries as a percentage of the total budgets in renewable energy is high, and can be taken as a positive indicator for investors as attractive locations for investment.

Figure 7. Current and future targets for ocean energy for European countries [3].

1.4 Capex and COE

An investor needs to ask “is the cost of renewable (and wave energy) competitive with other forms of energy”? The costs ultimately must be as attractive as fossilfuel prices to be worthy of investment consideration in the long run.

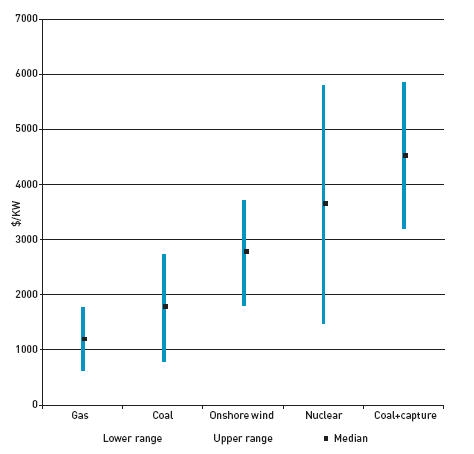

1.4.1 Capital Expenditure (Capex)

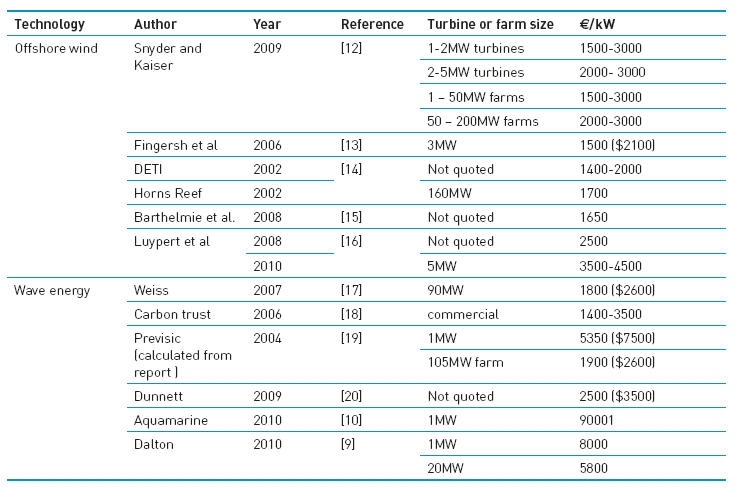

Capex is cost per kW (€/kW) or per MW (€/MW). This metric gives a direct relationship between the initial cost of the device and its rated power. It is neither location specific nor account for revenue. Statistics available for the Nuclear Association [8] show that that there is a wide range of Capex for various energy sources. Onshore wind is still more expensive than conventional fossil fuel sources such as coal and gas but cheaper than nuclear power (Figure 8). A more detailed literature review costs for offshore wind is displayed in Table 2 indicating that moving offshore incurs a higher cost than onshore wind, with Capex as highas € 4500/kW. Wave energy also is predicted to have a high Capex, ranging froma low of € 1400/MW to a high of € 8-10,000 by Dalton [9] and Cameron [10].

These very high Capex costs will require substantial support mechanisms to make wave farm ventures viable. It would also be assumed that learning curve and market demand will help reduce the Capex over time to similar levels of onshore wind. However, this cannot be assumed or expected, as per the example of offshore wind, where the price per MW doubled from year 2000 to 2010 [11], due to supply not meeting demand, as well as price increase in raw materials.

Figure 8. Cost per kW for various technologies, showing upper, lower and median value ranges. [8]

Table 2. Cost per kW for various offshore wind and wave energy studies. (€1 =US$1.4, €1 =0.82)

1.4.2 Cost of Electricity (COE)

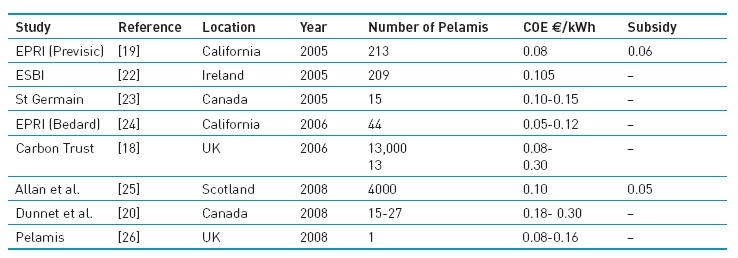

Cost of electricity (COE) is measured in €/kWh or €/MWH. This metric is most useful for providing an economic relationship between the cost of the project and the electricity output. COE is location specific and does not factor in revenue.The metric can be confusing as some economists include revenue in the figure, which makes it difficult to compare with other published results which do not account for it.

There are two methods to calculate COE:

a) Simple COE: The total Initial cost of the project is divided by the total annual energy output of the device per MW (not recommended).

b) Levelised COE: The levelised annual average costs of the project

including all annual OPEX costs are included in the estimate. This figure provides the most accurate metric for developers.

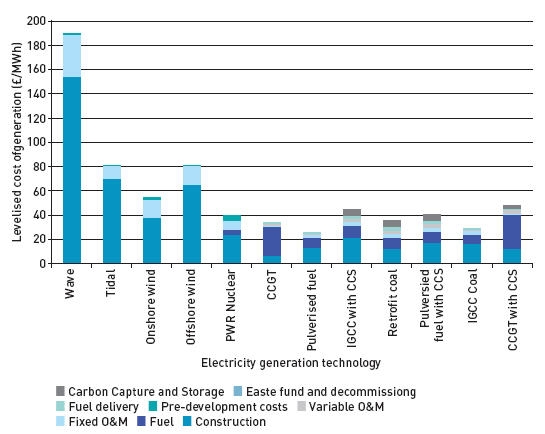

COE for wave energy is the highest amongst other renewable energy compared, as displayed in Figure 9, similar to trends discussed for Capex. However, caution must be exercised in using COE for the following reasons:

In conclusion, COE must be used with care when comparing technologies. Capex/MW can be more reliable. In general, wave energy will involve high costs, which need to be supported by mechanisms, such as grants or feed-in tariffs. These latter requirements will need to be carefully investigated in conjunction withCapex/COE analysis to gain the full picture of wave energy investment viability.

Figure 9. Cost of generating electricity (pence per MWh). [21]

Table 3. Wave energy device studies reporting COE using the Pelamis power matrix.

1.5 Support Mechanisms

An essential ingredient for consideration by an investor intending to invest inrenewable or wave energy technologies is the global support mechanisms promised by the government of the country under consideration. The currently available supports mechanisms (2010) for European countries are presented in Table 4.

Feed-in tariffs (FIT) schemes are the most prevalent support mechanisms for wave energy in Europe. The second most important mechanism is grant schemes provided. At present, the UK has the most comprehensive suite of grant support schemes. The largest support fund promised will come from the EU, called NER3005. The NER300 is a common pot of 300 million EU ETS allowances, which could be worth as much as € 4.5 billion if each allowance is sold for € 15. Up to 50%of “relevant costs” are funded under the scheme. Each member state will have allocated at least one and a maximum of three projects 6. A total of three ocean energy projects will be funded including wave tidal and ocean thermal. Wave energy devices of up to 5MW nominal power are eligible to apply 7. In conclusion, there are many support mechanisms available throughout Europe, either via FIT or grants. Investors will need to balance costs versus supports, as well as the local wave energy resource, to come to a final decision on whether to invest.

Table 4. Global support mechanisms for renewable energy in general8

2. Why Wave Energies – for Policy Makers in Europe

Government renewable energy policies are the principal driver of the growth in renewable energy use. Renewable energy policies exist in 73 countries around the world and public policies to promote renewable energy have become more common in recent years. The criteria for policy making decisions are slightly different than those for investors, when considering the options of investing inwave energy.

Policy makers will be looking at the national perspective, taking into account a larger suite of factors, not all having direct financial returns in the short term, if ever. The following is a directory of factors that will need to be considered from a policy making perspective.

2.1 Climate Change and CO2 Mitigation

The Organisation for Economic Co-operation and Development (OECD) states that technological innovation will play an important role in bringing down the costs of climate change mitigation over time [27]. It argues that a concerted research and development effort can be expected to yield important benefits, but not by itself. The International Energy Agency estimates that nearly 50% of global electricity supplies will need to come from renewable energy sources in order to halve carbon dioxide emissions by 2050 and minimize significant, irreversible climate change impacts [28]. With the adoption of the new “Energy from renewable sources” directive by the European Parliament and the European Council [29], the EU has committed to reducing its greenhouse gas emissions by 20% by 2020. It has been estimated that 300 kg of CO2 could be avoided for each MWh generated by ocean energy [3]. Therefore, for 20 GW (49 TWh/year) of installed ocean energy, the CO2 emissions avoided could be 14.5 Mt/year. These figures do not account for the baseload fossil fuel-produced power necessary to firm up ocean energy intermittency. The International Energy Agency (IEA) concludes, however, in the Energy Technology Perspectives Report [30] that ‘it is unlikely that wave energy technology will play an important role in climate change mitigation 2030’. It points to the need to develop appropriate wave energy policies and effective measures essential to accelerate the development and deployment of wave energy technology and to address the barriers identified. If successful, wave energy could play asignificant part in the effort to achieve global CO2 mitigation.

2.2 Security of Supply

The interdependence of EU Member States for energy, as for many other areas, is increasing – a power or gas pipe failure in one country has immediate effects in other countries [3]. A radical change is required in the way energy is produced, distributed and consumed. This means transforming Europe into a highly efficient, sustainable energy economy. Europe’s dependence on imported energy has risen from 20% at the signing of the Treaty of Rome in 1957 to its present level of 50%, and the European Commission forecasts that imports will reach 70% by 2030 [3]. A second EU report forecasts import dependence reaching 67% in 2030, with import dependence from oil continuing to be the highest, reaching 95% in 2030 [31].

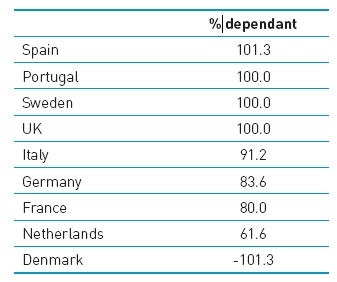

Some major European economies are already ahead of the general trend of dependency. The TG Trend report quotes that in 2007, Germany needed to import almost two thirds of its energy, while Spain and Italy’s dependency rates rose to 81.4% and 86.8% respectively [32]. With regards gas supplies, most European countries are even more vulnerable. Spain, Portugal, Sweden and the UK in 2007 relied 100% on imported gas (Table 5) [32].%

Table 5. Dependence on imported gas for selected EU countries 2007 [32]

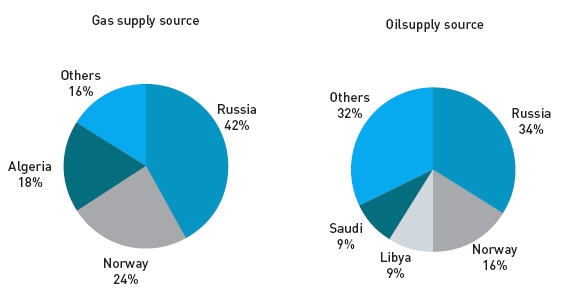

From a European perspective, the majority of supply sources are at present from areas in the world with least government stability, as is evidenced in Figure 10.The Russia-Ukraine gas dispute in January 2009 highlighted the impact that events far away can have on the transit of gas to the EU [33]. In conclusion, the use of renewable energy technologies increases the security of energy supply because they generally utilise indigenous resources [2]. Europe’s increase dependence on a limited number of energy sources, as well as supply and transport routes, should stimulate investor confidence in the need for investment in alternate energy technologies.

Figure 10. EU’s gas and oil imports 2006 [32]

2.3 A Diversified Energy Mix

A diversified energy mix, both geographically and technologically, can resolve the issue of variability. Ocean energy can bring added value to the European Union’s energy mix. Indeed, it has been established that wind and ocean energy are complementary. Studies performed on wind energy show that diversification at a national (supranational) level improves intermittency [34]. A recent RenewableUK study concludes that diversifying the renewable energy mix by including a greater proportion of marine energy would reduce requirements for reserve capacity and lead to annual savings in relation to the annual whole sale cost ofelectricity [35]. An Irish study concludes that the integration of wind and waves in combined farms, allows the achievement of a more reliable, less variable and more predictable electrical power production. This is particularly clear in the case of a relatively small and quite isolated electrical system such as the Irish one [36]. A British study also concluded that reducing the variability of the renewable electricity supply with a wide mix of renewables reduces the additional balancing costs required [37]. Finally, a US study also states that co-located offshore wind and wave energy farms generate less variable power output than a wind or wave farm operating alone [38]. The reduction in variability resulted from the low temporal correlation of the resources and occurs on all time scales.

In conclusion, wave energy may become a crucial ingredient in Europe’s energy portfolio – improving the quality of grid supply and reducing intermittency.

2.4 Job Creation

Ocean energy is well positioned to contribute to regional development in Europe, especially in remote and coastal areas. The manufacturing, transportation, installation, operation and maintenance of ocean energy facilities will generate revenue and employment. Studies suggest that ocean energy has a significant potential for positive economic impact and job creation. Parallels can also be drawn with the growth of the wind industry. Clean technology now account for € 7.1 billion annually in Denmark, while in Germany, wind technology exports alone are worthover € 5.1 billion. Based on the projections for installed capacity, by 2020, the ocean energy sector could generate over 26,000 direct and 13,000 indirect jobs [3]. By 2050 these numbers would increase to 314,000 and 157,000 jobs respectively.

In order to meet the Irish aspirational 500MW target, the Irish wave energy industry could produce 1,400 additional full time employment jobs and a net present value (NPV) of € 0.25 billion, rising to 17,000-52,000 FTE jobs and an NPV of between € 4-10 billion by 2030 [39].

Scotland has published several roadmaps for the development of marine energy [40]. The latest roadmap developed by the FREDS Marine Energy Group [41] estimates an overall expenditure of 2.4 billion to achieve 1,000MW installed in Scotland by 2020, generating 5,000 direct jobs.

In conclusion, the wave energy industry has tremendous potential in indigenous job creation.

3. Conclusion

‘Why invest’ in wave energy is a key question that must be answered before investors and policy makers make important decisions with regards investing both funds and time in the wave energy sector. This paper reviewed the key factors and data that need to be gathered and considered to help make a full analysis and decision.

Analysis of global supply of conventional fossil fuels, such as oil and gas, reveals that deposits are dwindling, and their prices are increasing. It is predicted that renewable energy sources, including wave, will fill the resultant vacuum. However, there are locations in the world which still have ample fossil fuel reserves and may be locations of less optimistic prospects for renewable energy interest and investment.

Demand side analysis shows positive indicators, both for global energy demandas well as global renewable energy demand. Forecast demands for wave energy, which are specified by targets, are also healthy.

The negatives that must be considered at present are very high Capex costs as well as the unit cost of electricity for existing wave energy devices. Capex hasr educed for most renewables with time, due to learning curves, but experience from the offshore wind industry in recent years has shown that elevated demandand supply bottlenecks can increase Capex costs with time.

Although costs can be a considerable barrier, much effort has been made by national governments to provide support mechanisms for the young wave energy industry. Support mechanisms consist of feed-in tariffs, grants and national targets. The drivers for policy makers in government to provide these support mechanisms are many and encouraging for the wave energy investor. Climate change and CO2 mitigation concerns must be addressed, as well as remedies for security of supply and reducing dependence on volatile supply sources. Renewable energy, especially wave energy, provides the obvious answer to these problems. Further benefits of adopting a diversified mix of renewables range from improving power output quality by reducing intermittency and variability to economic benefits due to green and indigenous jobs.

In conclusion, the investor can be encouraged that the majority of market drivers and indicators are positive toward wave energy at the present time, when macro economicand socio-economic factors are considered. The wind and solar renewable energy industries are providing confident indicators of promising futures for wave energy. However, cost considerations are the most pressing concern for wave energy, requiring concerted government support and future innovation to remedy these issues.

4. Acknowledgements

The contents of this paper contribute to the deliverables of the Waveplam project,which is supported by International Energy Agency’s Implementing Agreementon Ocean Energy Systems (IEA-OES) [42].

References

[2] Rourke FO, Boyle F, Reynolds A. Renewable energy resources and technologies applicable to Ireland. Renewable and Sustainable Energy Reviews 2009; 13:8: p.1975-1984.

[3] EU-OEA. Oceans of Energy – European Ocean Energy Roadmap 2010-2050. EuropeanOcean Energy Association (EU-OEA), 2010; http://www.waveplam.eu/files/newsletter7/European%20Ocean%20Energy%20Roadmap.pdf

[4] Knies G . Deserts as sustainable powerhouses and inexhaustible waterworks for theworld. Global Conference on Renewable Energy Approaches for desert Regions, Jordan.2006. http://www.desertec.org/downloads/GCREADER.pdf

[5] Energy Information Administration. Energy Information Administration, International Energy Annual 2006 2006; http://www.eia.doe.gov/iea/

[6] Mantzos L , Capros P. Energy and Transport: Scenarios on energy efficiency and renewables. European Commission and EC.Europa, 2006; http://ec.europa.eu/energy/observatory/trends_2030/doc/ee_and_res_scenarios.pdf

[7] Westwood J. Offshore wind – World market update. Offshore Wind Construction, Installation & Commissioning, London, UK. 2010. http://www.windenergyupdate.com/offshoreinstallation/

[8] World Nuclear Assoc. The economics of Nuclear Power. 2010; http://www.worldnuclear.org/info/inf02.html

[9] Dalton G J, Alcorn R, L ewis T. A 10 year installation program for wave energy inIreland, a sensitivity analysis on financial returns. Renewable energy 2010; In Press.

[10] Cameron L , Doherty R, Henry A, Doherty K, Van ’t Hoff J, D. K et al. Design of the Next Generation of the Oyster Wave Energy Converter. ICOE, Bilbao, Spain. 2010.

[11] Nielsen OB. The Ormonde Wind Farm: construction process for The UK sfirst full scale 5 MW offshore wind project. Offshore wind construction and installation conference, London, England. 2010. http://www.windenergyupdate.com/offshoreinstallation/index.shtml

[12] Snyder B, Kaiser MJ. Ecological and economic cost-benefit analysis of offshorewind energy. Renewable Energy 2009; 34:6: p.1567-1578

[13] Fingersh L , Hand M, L axson A. Wind turbine design cost and scaling model. National Renewable Energy Laboratory, 2006; http://www.scribd.com/doc/3862797/NREL-Wind-Turbine-Design-Costs-and-Scale-Model

[14] SEI. Cost benefit analysis of government support options for offshore wind energySEI, 2002; http://www.sei.ie/uploadedfiles/InfoCentre/offshorewindenergy.pdf

[15] Barthelmie R, Frandsen S, Morgan C, Henderson A, Christian HS, G arcia C et al.State of the art and trends regarding offshore wind farm economics and financing. RISO,2008; http://www.offshorewindenergy.org/ca-owee/indexpages/downloads/Brussels01_Economics.pdf

[16] Luypaert T, L ee S, Ellefsen PE. Energy 101: Offshore wind. MIT & LSPR, 2008;

http://www.mitenergyclub.org/assets/2010/3/4/Energy_101_Offshore_Wind_Energy_1.pdf

[17] Weiss JC, Boehlert BB, Baxter JR. Fiscal cost-benefit analysis to supportthe rulemaking process for 30 CFR 285. U.S. Department of the Interior, MineralsManagement Service OCS Study MMS 2007-050, 2007; www.mms.gov/offshore/alternativeenergy/PDFs/Final_Technical_Report_IEc_MMS_2008_0627.pdf

[18] Carbon Trust, Callaghan J. Future Marine Energy – Results of the Marine Energy Challenge: Cost competitiveness and growth of wave and tidal stream energy Carbon Trust – CTC601, 2006; http://www.carbontrust.co.uk/Publications/publicationdetail.htm?productid=CTC601&metaNoCache=1

[19] Previsic M. System level design, performance, and costs of California Pelamis wave power plant. EPRI, 2004; http://oceanenergy.epri.com/attachments/wave/reports/006_San_Francisco_Pelamis_Conceptual_Design_12-11-04.pdf

[20] Dunnett D, Wallace JS. Electricity generation from wave power in Canada. Renewable Energy 2009; 34:1: p.179-195.

[21] Gilmartin M. The economics of marine energy in Scotland & the UK. Forum on Economics of Marine Renewable Energy, HMRC, UCC, Cork, 2010.

[22] ESBI. Accessible wave energy resource atlas. ESBI Report 4D404A-R2 for Marine Institute (MI) and Sustainable Energy Ireland (SEI), 2005; http://www.marine.ie/NR/rdonlyres/90ECB08B-A746-4247-A277-7F9231BF2ED2/0/waveatlas.pdf

[23] St.Germain L A. A case study of wave power integration into the Ucluelet area electrical grid. 2005. Department of Mechanical Engineering, University of Victoria, Canada, http://www.iesvic.uvic.ca/publications/library/Dissertation/StGermain.pdf

[24] Bedard R. EPRI ocean energy program, possibilities in California. EPRI, 2006; http://oceanenergy.epri.com/attachments/ocean/briefing/June_22_OceanEnergy.pdf

[25] Allan G J, Bryden I, McGregor PG, Stallard T, Kim Swales J, Turner K et al. Concurrent and legacy economic and environmental impacts from establishing amarineenergy sector in Scotland. Energy Policy 2008; 36:7: p.2734-2753.

[26] Pelamis, Carcas M. The Pelamis Wave Energy Converter. Ocean Power Delivery Ltd, 2007; http://hydropower.inl.gov/hydrokinetic_wave/pdfs/day1/09_heavesurge_wave_devices.pdf

[27] OECD. Climate Change Mitigation-what can we do? Organisation for Economic Co-operation and Development 2008; http://www.oecd.org/dataoecd/30/41/41753450.pdf

[28] IEA. Press Release. International Energy Agency 2008; http://www.iea.org/press/pressdetail.asp?PRESS_REL_ID=271

[29] European Commission. Directive of the European parliament and of the Councilon the promotion of the use of energy from renewable sources. Commission of the European Communitees, 2008; http://ec.europa.eu/energy/climate_actions/doc/2008_res_directive_en.pdf

[30] IEA. Energy Technology Perspectives 2008. International Energy Agency; 2008.http://www.iea.org/Textbase/techno/etp/index.asp

[31] European Commission. Trends to 2030 – European Energy and Transport.EC.Europa, 2007; http://ec.europa.eu/dgs/energy_transport/figures/trends_2030_update_2007/energy_transport_trends_2030_update_2007_en.pdf

[32] DG Trade Energy and Transport. Pocketbook. 2007. http://www.eurotrib.com/story/2010/5/28/43128/4067

[33] DECC. Gas security of supply. Department of Energy and Climate Change, 2010;http://www.decc.gov.uk/assets/decc/what%20we%20do/uk%20energy%20supply/

energy%20markets/gas_markets/1_20100512151109_e_@@_gassecuritysupply.pdf

[34] Degeilh Y, Singh C. A quantitative approach to wind farm diversification and reliability. International Journal of Electrical Power & Energy Systems In Press, CorrectedProof.

[35] BWEA. The benefits of marine technologies within a diversified renewables mix. A report for the British Wind Energy Associationby Redpoint Energy Limited, 2009; http://www.bwea.com/pdf/marine/Redpoint_Report.pdf

[36] Fusco F, N olan G , Ringwood JV. Variability reduction through optimal combination of wind/wave resources – An Irish case study. Energy 2011; 35:1: p.314-325.

[37] Sinden G . Renewable energy: diversity and security. University of Oxford, 2006;http://www.ceem.unsw.edu.au/content/userDocs/GrahamUNSW-23Nov06-WebVersion.pdf and http://www.eci.ox.ac.uk/research/energy/downloads/sinden-powercost.pdf

[38] Stoutenburg ED, Jenkins N , Jacobson MZ. Power output variations of co located offshore wind turbines and wave energy converters in California. Renewable Energy2011; 35:12: p.2781-2791.

[39] Connor G . Economic study for ocean energy development in Ireland. SQW and SEAIand OEDU, 2010; Gary

[40] Dalton G J, Holmes B, Raventos A, Zubiate L , O’Hagan A. Wave energy – A guide for investors and policy makers. Waveplam, 2011; http://www.waveplam.eu/page/

[41] Marine Energy G roup. Marine Energy road map. Forum for Renewable Energy

Development in Scotland (FREDS), 2009; http://www.scotland.gov.uk/Resource/Doc/281865/0085187.pdf

[42] IEA-OES. IEA Ocean Energy Systems implementing agreement 5 year strategic

plan. IEA, 2006; www.iea-oceans.org/_fich/6/IEA-OES_Strategy_2007-2011.pdf